Transfer money quickly and securely with INTERAC e-Transfer†!

All you need is your recipent's email address or mobile phone number to send money in just a few quick and easy steps.

When to use INTERAC e-Transfer†:

- Splitting the bill in a restaurant

- Paying a roommate for your portion of rent or bills

- Sending some birthday cash to a family member

- Paying for everyday purchases such as housekeeping, babysitting or home repairs

Key Benefits:

Convenient and Simple to Use!

- All you need is your recipient’s email address or mobile phone number

- You can also transfer money to your other Canadian Financial Institution accounts

- Make or receive a transfer from anywhere at any time using your computer or Smartphone –

Internet Banking is available 24 hours a day, 7 days a week!

Saves Time and Money!

- No need to wait for the transfer to be approved – your recipient can access funds quickly

- No more stops at the ATM or waiting for cheques to be cashed!

- Lower cost than bank drafts or money orders

Secure!

- Your personal information is secure – email or text is used for communication purposes, but your funds are contained in our secure banking network

- No account numbers or other Financial Institution information is required

- A security question of your choosing protects your funds from being received by the wrong person

How to send and receive an INTERAC e-Transfer†:

- Log into Kerrobert Credit Union Internet Banking and select the “INTERAC e-Transfer” button.

- Set up your sender profile and add your recipient – make sure to create a Security Question that only your recipient knows the answer to.

- Choose how to notify your recipient, the amount you wish to send and which account the funds will be transferred from. You can also choose to send a special message or memo to your recipient.

- Send! The funds are debited from your account immediately.

- Your recipient will receive notification that you have sent them an INTERAC e-Transfer†, and will follow the links provided in the email or text message to deposit their funds.

- Once they have answered the security question correctly, they can deposit the funds immediately – no holds, no hassle!

- If your recipient’s Financial Institution does not subscribe to the INTERAC e-Transfer† service, it’s no problem! They can still receive their funds by following the link to Interac’s Interac Association’s site, at which time they will be asked to create or log into their existing account with Interac Association.

- Once logged in, Interac Association will proceed to deposit the transfer into their chequing or savings account (which usually takes 3-5 business days). For non-participating financial institution deposits, a $4.00 service fee will be deducted from the transfer amount.

Frequently Asked Questions:

1. What is Acxsys Corporation? Acxsys Corporation powers the INTERAC e-Transfer† service for the participating financial institutions. Acxsys Corporation facilitates the e-mail notice process and maintains the INTERAC e-Transfer† database.

2. How long does it take to send and receive an INTERAC e-Transfer†? An e-mail and/or SMS text message notifying the recipient of their INTERAC e-Transfer† is sent immediately after the sender completes the INTERAC e-Transfer†. Once the recipient receives notification, they can complete the deposit process, usually within just a few minutes of the transfer being sent!

NOTE:If your recipient’s Financial Institution does not subscribe to the INTERAC e-Transfer† service, they can still deposit their funds using the Acxsys Transfer process. This method of depositing an INTERAC e-Transfer† generally takes 3-5 business days, although it may take longer.

3. I sent a transfer but provided an incorrect e-mail address or mobile phone number for the recipient. What should I do? If you provided an invalid e-mail address, you will be notified via e-mail that the transfer notification was undeliverable. You can readdress and resend the transfer or cancel the pending transfer and the original amount (less the service charge) will be credited back to your account.

If you provided an invalid e-mail address, but did provide a valid mobile phone number, you will not be notified by e-mail that the transfer was undeliverable.

If you have provided an invalid mobile phone number and chose to notify your recipient by mobile phone only, you will not be notified in any way that the SMS text message did not go through.

4. How do I readdress and resend an INTERAC e-Transfer†? If you have been notified of an undeliverable INTERAC e-Transfer† due to an incorrect e-mail address, you can readdress and resend the transfer.

- Edit your recipient information to include the valid email address.

- Select the “Resend Notification” from the “Pending Transfer” screen

- Click “Confirm”

An e-mail notice will be resent to the recipient's valid e-mail address

5. How do I cancel an INTERAC e-Transfer† and deposit the funds back into my account? To cancel and deposit the transfer amount back into your account, you must check the status of the transfer – if the transfer is still in the list of Pending INTERAC e-Transfers†, simply click “Cancel” and follow the instructions. The transfer amount is automatically deposited back into the account indicated. Service charges are non-refundable.

If the transfer is no longer in your list of Pending INTERAC e-Transfers†, please contact your Credit Union for assistance.

6. Does the recipient get a reminder to deposit their INTERAC e-Transfer†? The recipient will receive email or SMS reminder of the outstanding transfer 7 days after it has been sent, then again at 14, 21 and 28. After 30 days, the transfer will expire and the recipient will no longer be able to deposit the funds. At that time the sender will be notified and can cancel the expired transfer to redeposit the funds.

7. What is a security question? What are the guidelines for the security answer? The security question verifies the recipient’s identity and protects your funds from being received by the wrong person. The question must be answered correctly in order to complete the deposit process. It is the sender’s responsibility to create a security question and answer known only to the recipient.

Guidelines for the security answer:

- The answer must be one word.

- The answer must not contain any blank spaces.

- The answer is not case sensitive and letters and/or numbers are accepted.

- The answer cannot contain special characters (i.e., &, $, etc.).

- The answer should be kept strictly confidential between the sender and recipient.

- The security question and/or answer must not be included in the optional message attached to the INTERAC e-Transfer†.

8. What happens when an INTERAC e-Transfer† cannot be received? The sender will be notified by e-mail when an INTERAC e-Transfer† cannot be completed because:

- The recipient declined the transfer.

- The 30-day time period for the recipient to claim the transfer has expired.

- The e-mail address you entered for your recipient is invalid. (See FAQ #3)

- The recipient was unable to answer the security question.

Once the sender receives this notification, they can follow the links in the message to cancel and re-deposit the funds. Service charges are non-refundable.

9. I keep getting an error message when sending or receiving an INTERAC e-Transfer†. There are several error messages which can be generated while using the INTERAC e-Transfer† feature, which may include the following:

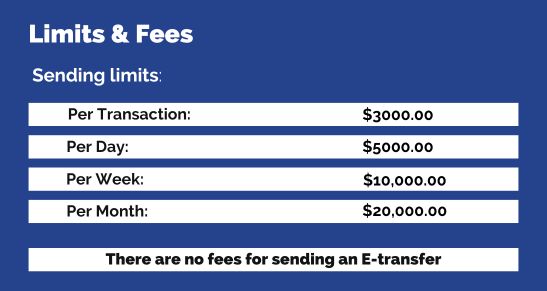

- Exceeds sending ⁄ receiving limits, for a single transaction, a week or a month.

- The account you are attempting to send from or deposit to is restricted from use with this feature.

- The communication between Internet Banking and your credit union's banking system has timed out.

For assistance with these issues, please contact Kerrobert Credit Union.

Learn more:

Looking for more information? Visit the INTERAC e-Transfer† homepage for more information on how this feature works, or contact us at (306) 834-2611 and speak to a Member Service Representative.

A list of participating financial institutions can be found here.

† Trade-mark of Interac Inc. Used under license.